Malta COVID-19 Wage Supplement: Payroll FAQs

- It is the government’s contribution to employers to support the wages of their employees through the COVID Pandemic.

- It is replacing the normal wages of the employee.

- It is taxable in the hands of the employee.

- The income will be added to any income received by the employee during the pay period.

- Tax and social security contributions (including Maternity) will be calculated in the standard method.

- The payslip will show the gross paid (i.e. €800 or the amount eligible).

- Payroll requires no changes.

- The employer must record receiving the wage supplement (e.g. €800) and paying this gross to employee.

- The wage supplement paid to employers will not be treated as income or a grant to the employer for Income Tax purposes.

- It is NOT taxable nor tax deductible.

- Government will give €800 (or less according to eligibility) to the employer for each employee

- Government will retain 10% SSC (€80 or less) as prepaid employees share of SSC.

- The employer will then calculate what is due to the CFR and deduct the amount of SSC prepaid to the CFR.

- On the FS5 Form, the total due to CFR less the SSC when the wage supplement is paid, will be shown in box D5.

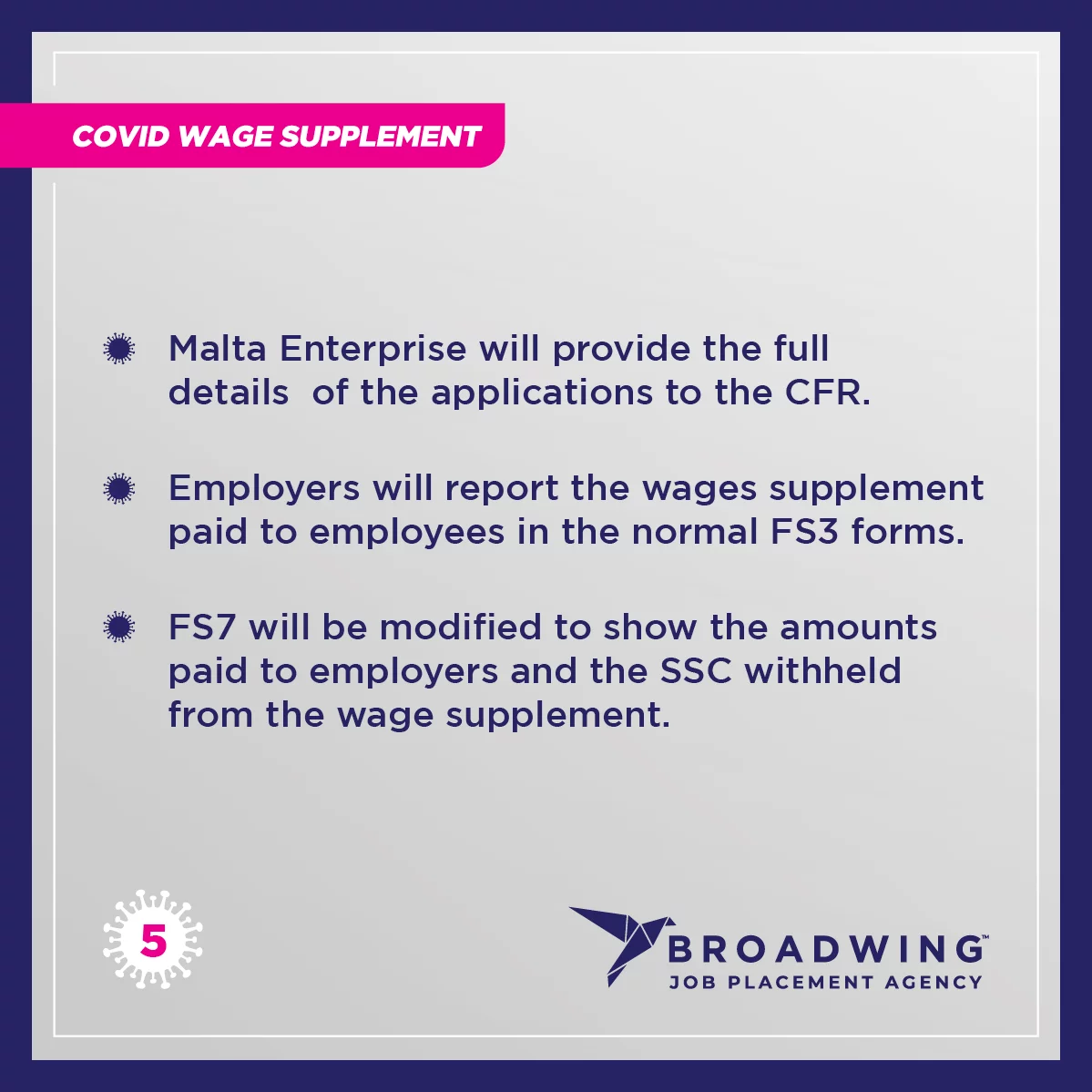

- Malta Enterprise will provide the full details of the applications to the CFR.

- Employers will report the wages supplement paid to employees in the normal FS3 forms.

- FS7 will be modified to show the amounts paid to employers and the SSC withheld from the wage supplement.